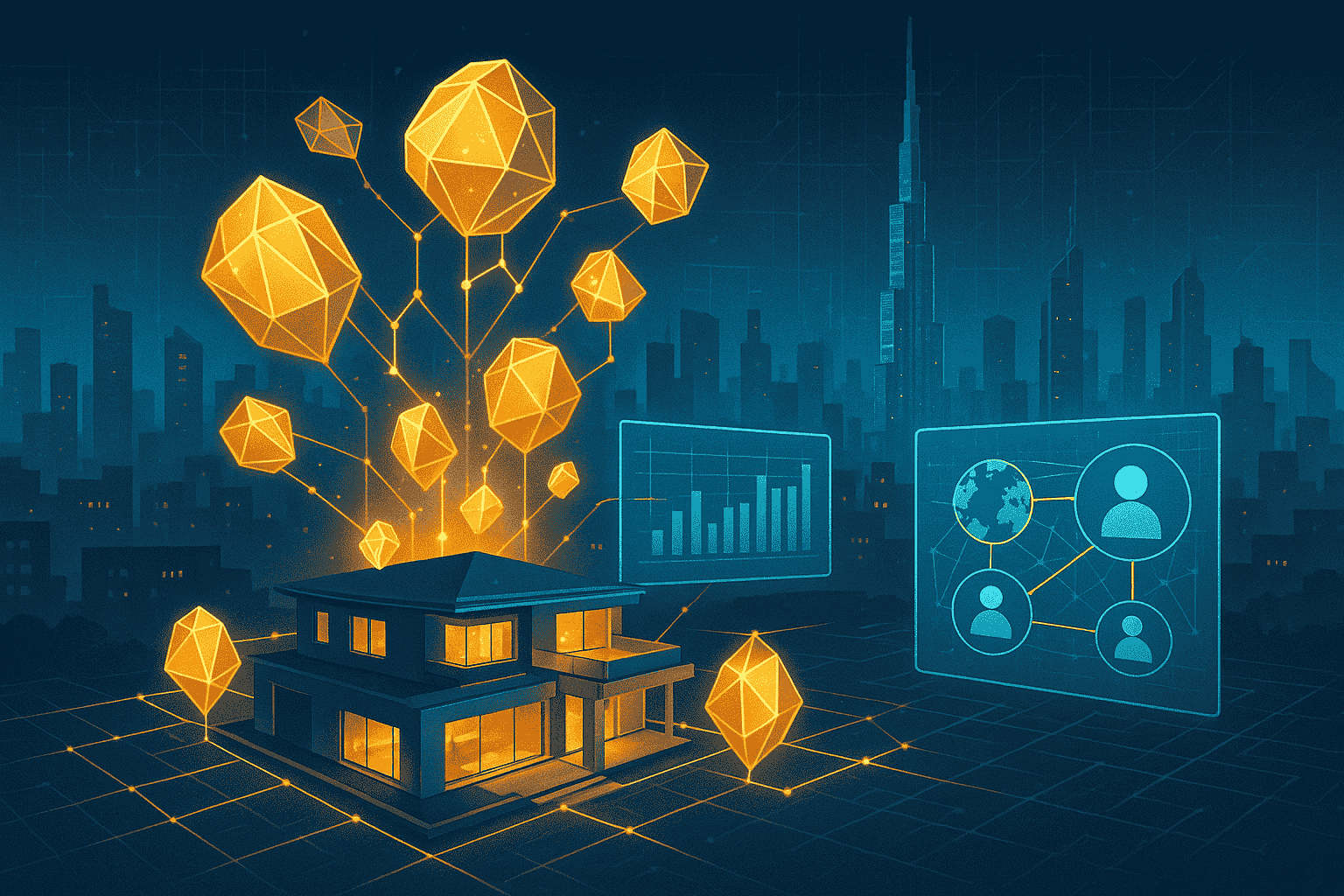

Explore how blockchain technology and property tokenization are making UAE real estate investment accessible to global investors with fractional ownership opportunities starting from just AED 1,000.

Understanding Property Tokenization

The UAE is pioneering a revolutionary approach to real estate investment through property tokenization, transforming how people invest in and own property. This cutting-edge technology is breaking down traditional barriers and creating unprecedented opportunities for both local and international investors.

Property tokenization involves converting real estate assets into digital tokens on a blockchain, allowing multiple investors to own fractions of high-value properties. Instead of needing millions to invest in Dubai’s premium real estate, investors can now participate with minimal capital while maintaining legal ownership rights.

This technology enables the division of a AED 10 million villa into 10,000 tokens, each worth AED 1,000, making luxury real estate investment accessible to a broader investor base. Each token represents a proportional ownership stake, complete with rights to rental income and capital appreciation.

UAE’s Regulatory Framework

The UAE has established a progressive regulatory environment for property tokenization. The Dubai Financial Services Authority (DFSA) and Abu Dhabi Global Market (ADGM) have created clear guidelines that protect investors while encouraging innovation. This regulatory clarity has positioned the UAE as a global leader in tokenized real estate.

The integration with Dubai Land Department’s systems ensures that tokenized properties maintain the same legal protections as traditionally owned real estate. Smart contracts automatically distribute rental income to token holders, providing transparent and efficient returns.

Investment Advantages

Tokenization offers superior liquidity compared to traditional real estate investment. While selling a property might take months, trading tokens can happen instantly on digital platforms. This liquidity premium makes tokenized real estate an attractive addition to investment portfolios.

Geographic diversification becomes effortless—investors can own fractions of properties across Dubai Marina, Downtown Dubai, and Palm Jumeirah simultaneously, spreading risk across multiple prime locations.

Market Opportunities

Several UAE-based platforms are already offering tokenized real estate investments, featuring everything from luxury residential towers to commercial office spaces. These platforms provide detailed property analytics, projected returns, and market insights, empowering investors to make informed decisions.

The rental yields from tokenized properties often exceed traditional investment options, with some platforms reporting annual returns of 8–12% for token holders in prime Dubai locations.

Future Implications

As the technology matures, we’re likely to see integration with other UAE initiatives like the Golden Visa program, where property token ownership could qualify investors for residency benefits. The combination of blockchain technology with UAE’s progressive policies is creating a new paradigm for global real estate investment.

Industry Statistics

- Market Size: The global real estate tokenization market is projected to reach $3.7 billion by 2025, with the UAE capturing approximately 15% of this market. (PwC Blockchain Analysis, 2024)

- Investment Accessibility: Tokenization has reduced the minimum investment threshold for premium UAE properties by 95%, from an average of AED 2 million to AED 100,000. (Dubai Blockchain Strategy Report, 2024)

- Liquidity Enhancement: Tokenized real estate assets demonstrate 300% higher liquidity compared to traditional property investments, with average transaction times of 24–48 hours. (Deloitte Real Estate Technology Review, 2024)

- Return Performance: Tokenized UAE properties have delivered average annual returns of 9.2% compared to 6.8% for traditional real estate investments over the past two years. (UAE Securities and Commodities Authority, 2024)